- Break Into VC

- Posts

- #15 - Venture Capital Fund Modelling: Masterclass III & Enterprise Sales Execs Have a Better Chance of Breaking Into Venture Than Finance Execs!

#15 - Venture Capital Fund Modelling: Masterclass III & Enterprise Sales Execs Have a Better Chance of Breaking Into Venture Than Finance Execs!

How the Venture Capital Fund Cycle Works? & Enterprise Sales Execs Have a Better Chance of Breaking Into Venture Than Finance Execs!

👋 Hey there! Welcome to Monday's edition of this week's Break Into VC Newsletter. We've got a packed issue focusing on everything you need to break into venture capital.

Deep Dive On Venture Capital Fund Modelling: Masterclass III

Break Into VC Hub: Get Access To 10000+ investors' email contact database & more.

Today’s Tips From VC Professional Enterprise Sales Execs Have a Better Chance of Breaking Into Venture Than Finance Execs!

15+ Venture Capital Job Opportunities.

Upcoming Global Online and In Person VC Events

Must Read Articles on Startups, Tech & Venture Capital

EXCLUSIVE AI EVENT

200+ hours of research on AI-led tools, business growth & hacks packed in 3 hours 🚀

This incredible FREE 3-hour Masterclass on AI & ChatGPT (worth $399) designed for marketers & founders makes you a master of 25+ AI tools, hacks & prompting techniques to 10x your marketing efforts & revenue.

This course on AI has been taken by 1 Million+ founders & entrepreneurs across the globe, who have been able to:

Automate 50% of their workflow & scale your business

Make quick & smarter decisions for their company using AI-led data insights

Write emails, content & more in seconds using AI

Solve complex problems, research 10x faster & save 16 hours every week

DEEP DIVE

Venture Capital Fund Modelling: Masterclass III

In last week editions newsletter we discuss about How VC Firms Calculate the Average Check Size For Startups and How VC calculate the Target Ownership Stake In A Startup . If you haven’t read that I highly recommend to spend some time to read.

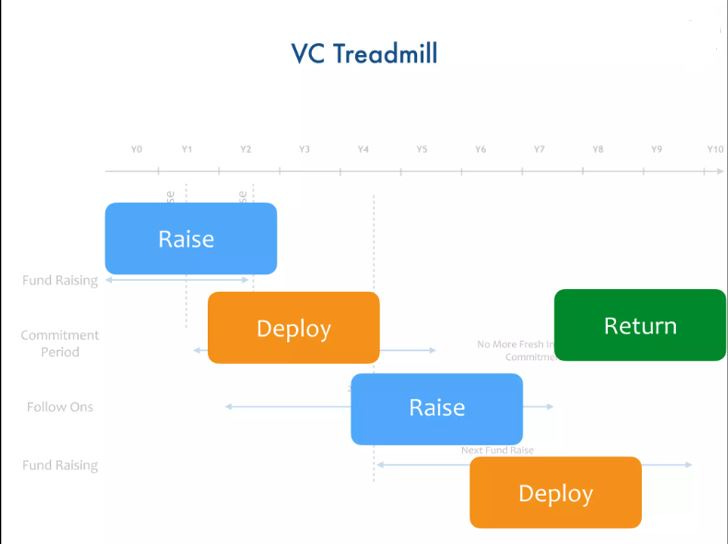

In today’s writeup, I’ll share How the Venture Capital Fund Cycle Works? VC fund cycle also known as “VC Trademill”, read along you will get the idea on why this name? Let’s deep dive into it.

Take a close look at the below image of the timeline of the VC fund:

Don’t get confused with the terms or complexity described in the image. I will explain to you all the terms described in the image.

From the image, it’s clear that - the fund life of this VC fund is about 10 years. ( Horizontal line from Y0 to Y10)

Raising funds for a new venture capital (VC) fund is a challenging task for General Partners (GPs) who hold higher positions. GPs typically start by seeking investments from Limited Partners (LPs), including High Net Worth Individuals (HNIs), Family Offices, and School endorsement funds.

Typically, it takes approximately 2-2.5 years for new funds to secure the total capital from LPs. For instance, if a group of GPs aims to raise around $50 million from LPs, the fundraising process would generally span 2-2.5 years. It's worth noting that even for lower amounts, such as $25 million, the duration for raising the funds remains similar.

The process of raising funds for a new venture capital (VC) fund is typically divided into two stages: the first close and the final close, as depicted in the image. During the first close, which typically takes around 1-1.5 years, the General Partners (GPs) aim to secure approximately 40-50% of the total targeted fund to be raised from LPs ($50 million in this case). The remaining portion of the funds is then raised during the subsequent 1-1.5 years, leading up to the final close.

But what after the first raised (40%-50% of decided raised capital) - Does VC start to invest in startups / start to charge Management fees OR wait to raise the rest of the money and then start the investment?

Generally, after First Raised, VCs start to invest in the startups over the commitment period which is about 3-5 years. In the Commitment period - VCs will do the fresh investment in around 10-15 startups (depending on investment strategy). Simultaneously, VCs begin charging management fees over the fund's lifespan. These management fees usually amount to around 1.5%-2% annually.

“But till the first raised - the VC business worked kind of a bootstrapped startup.”

The commitment fund is designated for investing in newly established startups. However, once the commitment period concludes, VCs are no longer able to make investments in additional startups. Instead, they shift their focus to follow-on investments, which typically occur around two years after the commitment period.

The follow-on investment phase extends from the initial fundraising to approximately 7-8 years into the fund's lifespan, as depicted in the image. During this period, follow-on investments are made in the startups that were previously invested during the commitment period.

Typically, VC funds are organized into Fund I or Fund II, as you mentioned. Fund I is formed by combining the capital raised during the first and final raises. However, once the commitment period concludes, VCs are unable to invest in new startups. To avoid being unable to invest in fresh startups, VCs initiate the process of raising funds from Limited Partners (LPs) for Fund II. Fund II fundraising usually begins before the end of the 1-1.5 year commitment period.

This cycle of raising funds and deploying them into startups forms what is known as the VC Treadmill, where VCs continuously seek new funds to sustain their ability to invest and support startups.

VC Treadmill:

Source: Google Images

Raised Fund → Deployed in startups → Raised Fund → Deployed in startups

The primary responsibility of raising funds from LPs in the VC business primarily falls on GPs or MDs. It is the GPs and MDs who handle investment decision-making, fund operational activities, fundraising efforts for new funds, providing support to portfolio startups, and presenting the fund's performance to LPs. Individuals working in the VC industry can envision the extensive workload involved in these tasks, which encompass a wide range of responsibilities to ensure the success and growth of the fund.

That’s it. I hope you are able to understand the lifecycle of a VC fund and the most common terms used in this space.

VC CRAFTERS HUB

Access Curated Resources, Support Our Newsletter

With lots of requests from you about getting a verified contact (email/LinkedIn) database of investors, we have created a database of VCs/Angel investors.

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Early Stage Startup Financial Model Template For Fundraising (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

TODAY’S TIPS FROM VC PROFESSIONAL

Enterprise Sales Execs Have a Better Chance of Breaking Into Venture Than Finance Execs!

A good framework to understand venture, at least the upper tier of the venture world of repeat founders or experienced operators, or sell-side venture as I termed it above, is to see it as a market where the VC is a purveyor of their brand of capital.

In the case of venture capital firms, all members of the investment team are purveyors of the firm's unique brand of capital. This typically consists of:

$X-Y million (the firm's standard investment amount)

Investment team's (Partner or Investment Lead's) time and expertise

Platform services (recruiting, fundraising support, etc.)

Effectively, VC firms are selling this bundle to founders, with equity in the founders' company being the only currency they accept.

Now, each VC firm's brand of capital is distinct from others, even if the investment amount is the same. This distinction comes from:

The specific Partner's time and network

The brand signal associated with the VC firm

The unique platform services assembled by the Partner and investment team

These factors contribute to the overall value proposition that differentiates one VC firm's offering from another in the competitive landscape of startup funding.

Founders choose the brand of capital they believe will best accelerate their enterprise's growth, paying for it with company equity.

VCs must be selective in determining which companies' equity to acquire, as they typically manage a portfolio of 25-35 companies. They aim to ensure these investments grow significantly in value, with about 3-5 needing to perform exceptionally well due to the power law in venture business. The general assumption is that more experienced founders have higher chances of success, leading to greater equity value growth.

The VC economic model can be summarized as:

Product: Their brand of capital

Currency: Startup equity

ICP (Ideal Customer Persona): Repeat or rising founders

In this context, a VC's role becomes similar to an Account Executive (AE) in an enterprise SaaS company. They are responsible for identifying, contacting, engaging, and persuading elite founders to accept their brand of capital.

From this perspective, venture capital essentially functions as enterprise sales.

Viewing venture capital through the lens of enterprise sales, top-tier firms recruit candidates who can effectively connect, engage, and persuade elite/repeat/rising founders. Key indicators of this ability include:

Past experience as a founder, VC, or senior operator

Access to relevant networks (e.g., academic or corporate pedigree)

Content creation and personal branding in startups/venture

Involvement in startup-related community organizations

Experience in venture or angel investing

Track record of supporting or advising founders

The single decisive factor in hiring is the candidate's perceived ability to reach out, engage, and persuade founders to accept the firm's capital. While finance skills matter, they are secondary to the ability to convince founders that the firm's capital is superior to alternatives.

In essence, top-tier venture recruitment focuses on identifying individuals who can effectively "sell" the firm's brand of capital to high-potential founders, rather than primarily emphasizing financial expertise.

VC JOB OPPORTUNITIES

15+ VC Job Opportunities - Internship to Full Time Job Roles

Scouting Manager - Antler | Australia - Apply Here

Venture Analyst - edge case capital partner | USA - Apply Here

Founder Scout (Internship) - Antler | Sweden - Apply Here

Senior Vice President - City Venture | USA - Apply Here

Senior Vice President - City Venture | UK - Apply Here

Investment Principal - Munich Re Venture | USA - Apply Here

Accounts Payable Analyst - Y Combinator | USA - Apply Here

Analyst - Qi Venture | India - Apply Here

Associate - SCB 10X - Apply Here

DevRel - GrayScale Venture | India - Apply Here

Events Lead - Upfront Venture | USA - Apply Here

Marketing & Community Manager - Agfunder | Singapore - Apply Here

Analyst, ClimateTech Venture Creation - Diagram | Canada - Apply Here

Principal - Blackhill fund | India - Apply Here

Portfolio Manager - Scientifica | Italy - Apply Here

Want daily VC Job updates/want to learn about VC from basics... Join our VC Crafters' Slack community to learn, network and craft your path to venture capital...

DON’T FORGET

How Can a Software Developer Break Into VC? - Read the Journey.

Check out SWE2VC article’s to get updates on how can someone from SWE break into VC.

Get High-quality software startups delivered straight.

Get access to venture scalable software startups direct to your inbox. It’s read by leading VC firms, check out here.

VC EVENTS

Upcoming Global Online and In Person Startups & VC Events

FREE 3-hour Masterclass on AI & ChatGPT (worth $399) designed for marketers & founders makes you a master of 25+ AI tools, hacks & prompting techniques to 10x your marketing efforts & revenue. Register & save your seat now (100 free seats only) → (Highly Recommend)

Fireside Chat: Leadership Paradigm for a Disruptive World with VC Partners | Aug 1st - Reserve Your Seat (Online)

Climbing the VC Ladder: Analyst to Partner, 'Anti-Dilution' Learning Series by India Quotient | Aug 1st - Reserve Your Seat

GP/CVC Roundtable on AI in the Physical World | Aug 14th - Reserve Your Seat

VC CRAFTER’S PICKS

Must Read Articles On VC, Startups & AI

How Urvashi Barooah broke into venture after everyone told her she couldn’t?

VC fund decks that raised $500 Million From LPs... Read Here

Unpacking Alpha in Venture Capital

Is a Venture Firm More Than the Sum of Its Partners?

VC Funds 101: Understanding Venture Fund Structures, Team Compensation, Fund Metrics and Reporting

The Economics of VCs Recycling Management Fees

Persistence in Venture Capital Returns

Maximising Fund distributions

A KPI dashboard for early-stage SaaS startups

How Do Limited Partners Evaluate VC Fund Performance?

Join our VC Crafter slack community to learn, network and craft your path to venture capital.

That’s It For Today! We’ll be back in your inbox On Wednesday.